This is why certain Small business Administration money was arranged

Industrial mortgage loans can be found in small regards

When it comes to the fresh fee build, anticipate industrial finance to vary on old-fashioned amortizing plan. A lender asks a debtor to invest an entire financing just after 10 years with a lump sum payment. This will be called an excellent balloon fee, for which you afford the total leftover equilibrium by the end out of brand new agreed label.

For instance, a commercial loan provides good balloon payment due when you look at the 10 years. This new payment is dependant on a vintage amortization agenda instance a 30-season financing. Basically, you only pay the initial ten years out-of prominent and you will attract payments according to the full amortization dining table. Just like the label ends, you make the fresh balloon percentage, and therefore pays off the remaining balance in the financial.

Furthermore, you’ve got the choice generate attract-only repayments into the a professional loan. It indicates you don’t have to worry about and also make dominating costs for your title. Additionally, due to the fact financing title is through, you should settle any kept harmony that have a balloon fee.

Occasionally, industrial loan providers offer fully amortized finance as long as 20 or 25 years. And you will with respect to the industrial mortgage and you may financial, some higher commercial mortgage loans may be offered a term off 40 ages.

Industrial Loan Installment Analogy

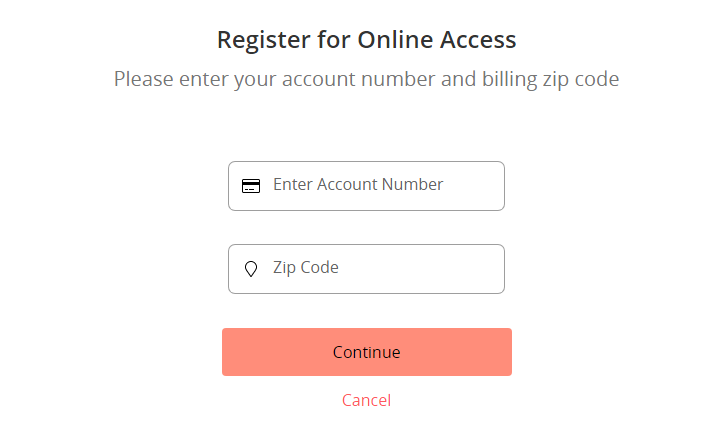

Knowing just how industrial money really works, why don’t we opinion this case. Let us presume the commercial home mortgage try $dos.5 billion that have 9 per cent Annual percentage rate, which have financing name from ten years. Why don’t we use the calculator on top of this web page in order to guess their monthly payment, interest-simply fee, and full balloon percentage.

- Industrial amount borrowed: $dos,500,000

- Interest: 9% Apr

- Term: ten years

With respect to the abilities, the monthly industrial homeloan payment could be $20, for 10 years. If you make focus-simply payments, it does just be $18, monthly. Because the a decade is right up, you should make a good balloon commission away from $2,240, to repay their left balance.

Either, you may not be able to create an effective balloon commission towards the industrial financial. When you find yourself concerned with decreased loans, re-finance through to the stop of the term. Initiate inquiring from the refinancing about per year before label concludes. This may help save you off foreclosures and losing the lender’s believe. For many who default on your own mortgage, it spells not so great news for your credit history, therefore it is hard to find acknowledged for upcoming commercial funds.

Industrial refinancing is actually taking out a different financial. It will help your reconstitute your own fee to the a price you are able to afford. In addition allows you to lower your rate of interest or take a workable percentage name. To re-finance, you must as well as see bank qualifications. Lenders perform criminal background checks on the private and you will organization credit score. They’re going to also query just how long you had the possessions.

Commercial A home Interest rates

Commercial financing costs are a little higher than domestic mortgages. It certainly is as much as 0.25 percent to 0.75 per cent high. In case your assets need more active government such as for example a motel, the rate can increase. According to the place and type off money, industrial financial cost normally are priced between 1.176 % around a dozen per cent.

Commercial a house loans are very experienced illiquid possessions. Rather than domestic mortgage loans, there aren’t any prepared secondary segments to possess commercial funds. This makes them more difficult to offer. Hence, high cost are assigned for purchasing commercial property.