Situations affecting financial aid disbursement through the kind of help and you may the year at school

Article Advice

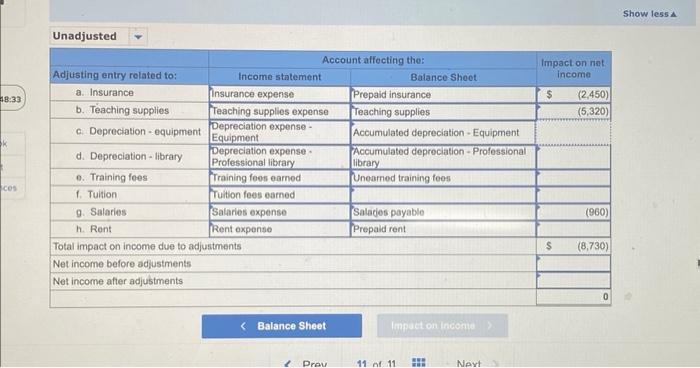

Usually, issuers publish debt assistance loans directly to the school, additionally the school upcoming applies the cash on the university fees, charge or other expenses. When there is currency left over, the school will be sending the rest to you personally, and you will put it to use to cover your own almost every other expenses, like your books otherwise transport.

Educational funding disbursement schedules are different by the university, but they are basically anywhere between ten days till the beginning of the session and you can thirty day period just after categories begin.

Disbursement out-of college loans and you will provides

Which have each other features and you can student loans, people aid you discover could be instantly put on the college or university-requisite tuition, charges and you will (if you’re way of living for the campus) your room and board.

Colleges usually disburse school funding in two money for each and every instructional season, therefore you should have a few school funding disbursement dates. Such as for instance, you’d likely found you to disbursement in the beginning of the slide session, and one at the beginning of new springtime session.

For those who have school funding left following the college or university applies it into the tuition and other required expenses, it can disburse the remainder to you personally. Universities need to situation the remaining amount to you inside two weeks if you do not authorize your university to keep the bucks to blow to own coming charge.

30-big date slow down

Whenever you are an initial-year undergraduate and you will taking right out government figuratively speaking into the very first go out, you’ve got a longer wishing period. First-seasons borrowers is actually subject to a thirty-time decelerate pursuing the first day of one’s school’s wishing period till the college is actually allowed to disburse the loan loans. Only a few universities use the 30-day rule, but not, very speak to your college’s financial aid office to see if they relates to your.

Entrances guidance

First-date consumers of government Head

A comparable holds true for scholar and elite college students taking aside Head As well as money for the first time — while having fun with government college loans to pay for scholar school, you ought to complete entrances counseling, also.

Keep in mind that entrances counseling need to be completed inside a single lesson, so make sure you have time before you start.

Most other disbursement requirements

To avoid any possible disbursement waits, be sure to maintain every following jobs just like the in the future to:

- Sign up for the number of groups wanted to meet the borrowing from the bank criteria for the student services.

- Look after people difficulties with your own 100 % free Software to own Federal Student Help (FAFSA) which means your educational funding disbursement is found on time.

- Sign your Grasp Promissory Mention (MPN) having Head paid and you can unsubsidized loans.

When your finance is actually paid, you can aquire two notifications: You to on college suggesting the help might have been disbursed, plus one out of your mortgage servicer guaranteeing this new disbursement.

Refunds

In the event that discover people money from the fresh grant otherwise student loan disbursements left-over immediately following university fees, charge, and you will room and you can board are paid down, the rest harmony — also referred to as an excellent borrowing harmony — was paid off directly to your in the way of bucks otherwise evaluate, normally transferred to your checking account.

- Utilize it to fund other college or university expenses, eg guides, supplies and you will transportation.

- Go back the fresh student loan currency you don’t have. Of the coming back additional education loan money, you could potentially stop your student loan personal debt and relieve desire charge. You might get back the fresh empty piece — without paying notice otherwise costs on that matter — contained in this 120 days of the fresh disbursement big date. After that, you might repay it, however, interest and fees get accrued.