Should i still get loans versus taking my tax statements?

If you have currently called y

Hit due to the fact iron’s hot!

Before banking crisis away from 2008, financial institutions have been creating money so you’re able to anyone who you’ll fog a reflect. Subprime lending and you may Alt-An applications caused it to be easy to be eligible for property loan, just about anyone can be a citizen. With respect to the timing, people really benefited because of these form of software, they could acquire several services and often flipped them to own huge earnings or leftover them because of their profile. Although secret here are their time, it got advantage of the latest apps that were to and from now on that those apps aren’t available anymore its more difficult to locate characteristics and come up with currency. Option business lending will be up to for as long as brand new finance which might be financed are trying to do. In lieu of the borrowed funds drama where these types of finance reach default, banking institutions had to prevent funding not as much as the individuals details.

Protecting a corporate Loan with reduced if any Papers

Of numerous loan providers usually demand individuals doing numerous forms, surrounding bank comments, asset verification, tax returns, harmony sheets, income validation, and much more. When you are a thorough documentation processes can offer benefits, additionally, it may show exceptionally big date-taking. Old-fashioned finance companies, recognized for its sluggish pace, tend to get-off individuals awaiting working capital for longer periods.

Luckily you to definitely small business owners currently have the newest substitute for receive loans with minimal in order to no papers requirements. In the beginning Financial support Business Financing, we get rid of the dependence on excessive financial record distribution so you can lenders. We optimized new financing techniques getting convenience and you will performance.

Recognizing you to small business owners head busy lifestyle, our very own reasonable-records finance are capable of rates, allowing you to spend some your time and effort in which it issues most.

Based on the person you plan to squeeze into, each of them possess various other standards. Nevertheless the popular activities requisite whenever trying to get a working resource financing:

- 3 to 6 weeks lender comments regarding all the team bank accounts for recent months

- 3 to 4 months bank card control statements for present months for folks who organization process handmade cards

- Software (that is between one to two users, however, standard pointers)

Hardly will you see lenders requesting tax statements or financials, yet not it’s not strange to your large mortgage number. Stuff mentioned above will be sufficient to allow you to get a keen respond to if they present a corporate loan. Turnaround minutes to obtain an answer often is within this 24 times, whether your bank/representative youre dealing with try getting more than 2 days you might want to you better think again just who you are employing. For those who agree to the brand new conditions you could have financing records within the same go out, at that point the lender could well be asking for extra items.

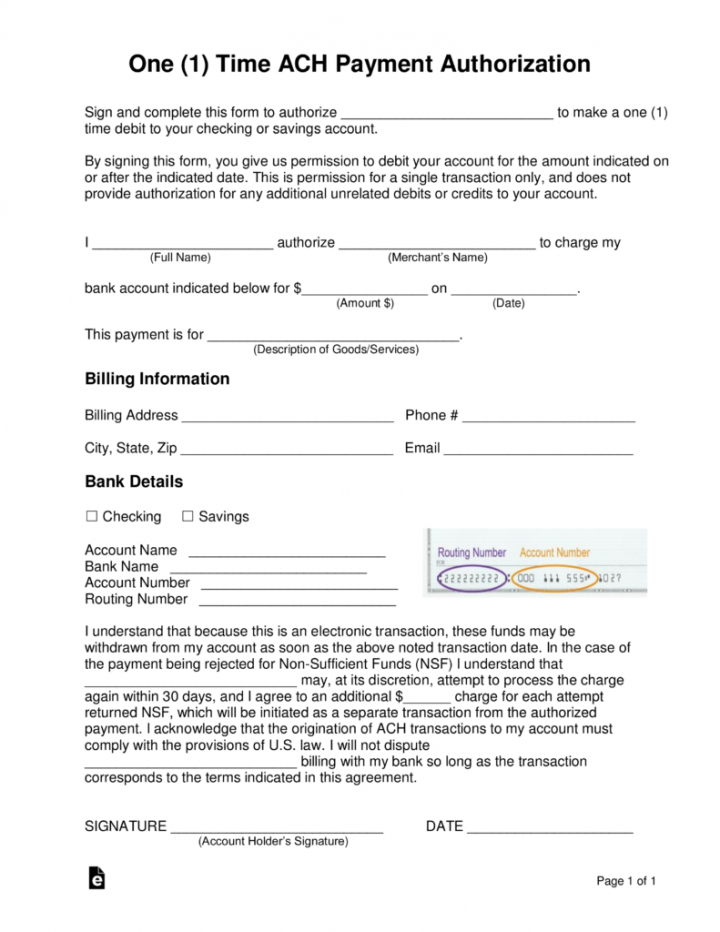

- Nullified look at in the organization bank account so they are able wire money

- Backup away from Vehicle operators Permit or Passport to show you are the entrepreneur(s)

- Sometimes they should do an internet site . check of your own organization to make they feel more more comfortable with new financing.

- Copy of nullified local rental check if your business is renting it’s place, when you have a mortgage they’re going to want to see the newest financial report showing that you’re latest.

- Verbal confirmation into the business person as well as the investment source, they go over the loan terminology into business person one more time to ensure they know all of them.

Develop that leave you wise about what could be required whenever applying for a low-conventional business mortgage. There’s another great webpages having a wealth of details about loans, listed below are some you away to learn more on the business funding. Needless to say we have all a special condition along with your situation might possibly be a little more, if you like to learn more please cam having our company innovation managers. They may be hit during the 888-565-6692 .