Pre-Property foreclosure and the Steps in the newest Property foreclosure Techniques

Many people understand what property foreclosure was, exactly what was good pre-property foreclosure family? Given that label suggests, it comes down prior to a lender commercially starts foreclosure procedures.

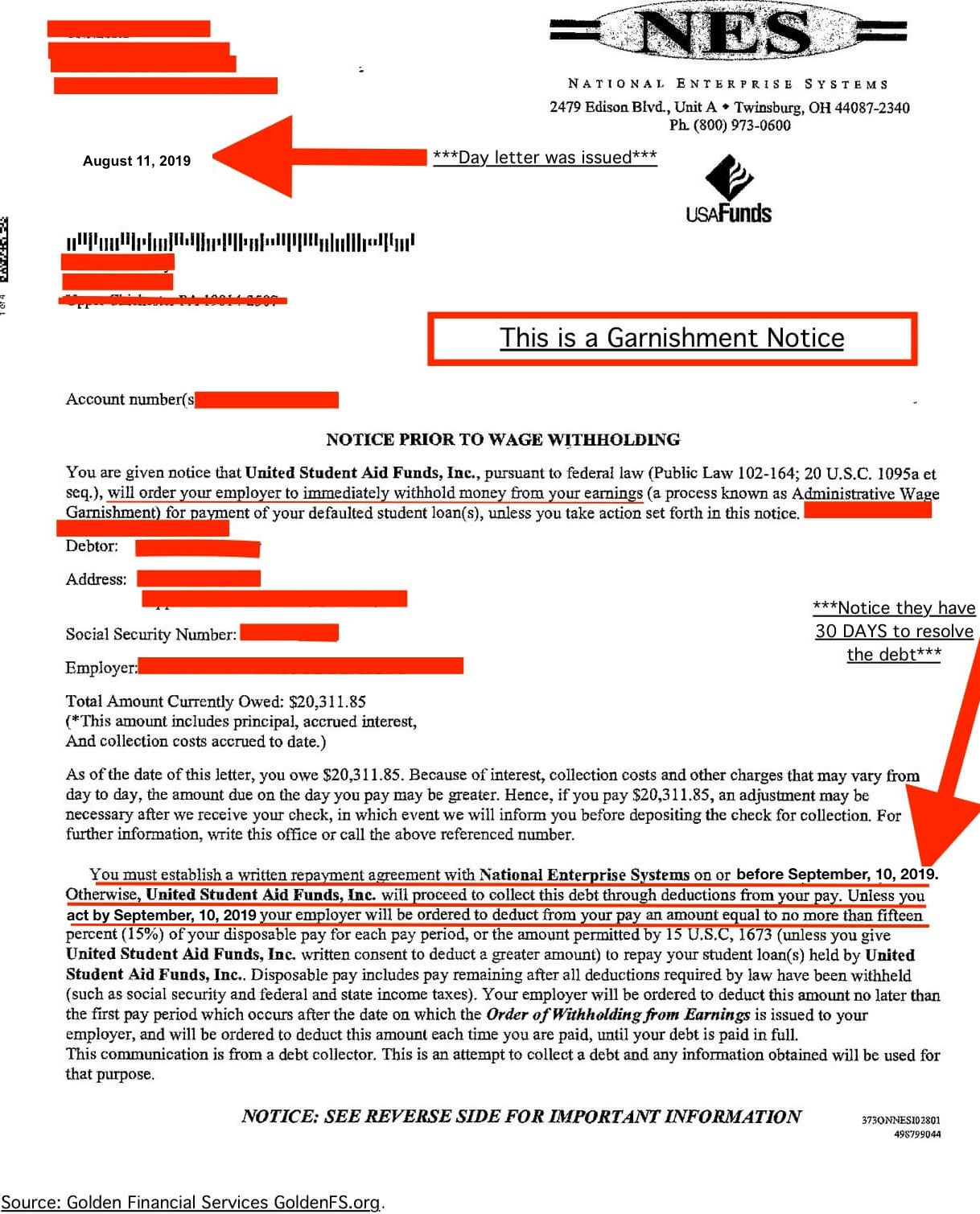

Whenever a citizen defaults to their mortgage by the neglecting to make repayments, the financial institution or financial contains the directly to foreclose. The latest foreclosure process comes to repossessing the house and you will evicting the individuals life style truth be told there. In advance of that happens, however, the resident is offered a final alerting in addition to

A resident in pre-property foreclosure continues to have a chance to continue their home, even so they can also desire offer. People considering to buy a good pre-property foreclosure family should comprehend the process and exactly how they impacts this new home-to get experience.

The fresh regards to home financing bargain establish whenever costs is due, and exactly how of several missed money it requires to settle default. This might be typically around three costs, but it can vary.

The lender will post good see of default page towards the resident, telling them your house is in the pre-foreclosures. Pre-property foreclosure lasts 120 days, delivery in the event the first mortgage percentage try overlooked.

After brand new 120 months, the house moves from pre-foreclosures to foreclosure . The bank directs a good observe from business, record this new big date once they plan to hold an auction in order to sell the home. Pursuing the selling, the occupants normally have three days to maneuver aside. If a buyer is not available at public auction (money is constantly needed to buy at public auction), your house becomes REO (a property owned) property. It indicates the financial institution is the owner of the home and can just be sure to sell it to your open-market-additionally the residents have to leave.

Homeowner Alternatives With property inside the Pre-Foreclosure

Pre-foreclosure cannot usually produce property foreclosure. There’s something a citizen perform during the 120 working-day several months to leave of pre-foreclosure and steer clear of foreclosures proceedings.

- Developed the money. In the event the a homeowner could possibly catch up and afford the late home loan repayments, they may be able get out of pre-foreclosure. The loan price goes on because the ahead of, considering it match future costs.

- Discuss for a financial loan modification. In some instances, a lender can be ready to negotiate the fresh new terms of the latest financial, possibly of the adjusting the pace therefore monthly premiums are lower. Otherwise, they may invest in tack the fresh overlooked costs onto the end of the mortgage. A bank will be far more prepared to do that if for example the citizen keeps an eye on spending timely that will be which have financial troubles on account of certain temporary circumstance, such as unemployment otherwise infection.

- Deed as opposed to foreclosures. Its uncommon, many lenders get create a citizen to hand more its action and leave from their mortgage. Which generally speaking only takes place in a hot housing market, the spot where the financial try convinced they can promote the home for more than they would score away from percentage of the brand new financial.

- Promote the home when you look at the a primary business. An initial selling happens when an excellent residence’s marketing pricing is quicker than the an excellent mortgage equilibrium. Because they could well be losing profits, the financial institution need agree a primary sales prior to it being closed. The brand new continues of the profit go right to the financial, as well as will not need to undertake the responsibility from offering your house. At the same time, the newest citizen stops property foreclosure and you will future mortgage repayments (but need to today discover someplace else to reside).

What is actually a beneficial Pre-Property foreclosure Family?

To possess property owners just who desperately want to stay-in their houses, it’s always best to manage to shell out otherwise was so you can discuss towards the bank. In the event the none of these is possible, next most sensible thing is to sell our house or hands over the action if residence is however for the pre-foreclosure. As overlooked payments usually matter facing good homeowner’s credit score, a foreclosures are tough. Going through a foreclosure helps it be more tough to get financial support in the future , given that loan providers may find it as too risky.