Just how getting married has an effect on loans, taxation and you can borrowing from the bank

Merging existence setting merging monetary facts, even although you keep bank accounts independent. Different people provides towards matchmaking their financial history, and this you are going to tend to be student loans or other financial obligation.

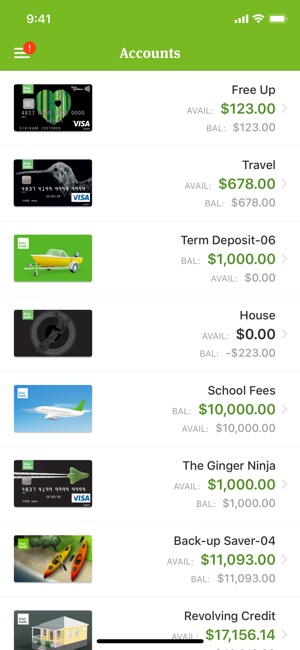

Ahead of your wedding, it is best to review your finances together so there will

How can figuratively speaking impact relationships?

According to Forbes, student loan loans ‘s the second-high personal debt group in america. Over forty-two million Us citizens keeps education loan obligations. It’s possible that you will be marrying people that have education loan personal debt, or you may have student loan financial obligation on your own.

Even when the debt is just in a single man or woman’s identity, it does nonetheless connect with each other couples. This is because money should be assigned each month in order to investing out of one to obligations, and the process usually takes date, based on how much you owe in addition to period of the latest financing identity. Investing that cash back has an effect on your money flow and you will offers.

For those who accumulate education loan financial obligation throughout the relationships, that will plus apply at each other people, especially in a residential district assets condition. That is right even if the loan is just in a single man or woman’s title.

Really does marriage affect your credit score?

The way in which relationship affects fico scores try difficult. When you find yourself your credit score must not be in person impacted by your wife or husband’s student education loans, if the money had been taken prior to getting hitched their spouse’s credit score have a tendency to dictate the rate a lender now offers when you’re obtaining additional fund with her.

This means for many who submit an application for home financing or car loan along with her, the financial institution will appear from the one another fico scores when deciding the new rates. Having education loan obligations does not always mean the credit score was down, however it can also be harm what you can do to obtain a lot more money while the the financial institution investigates your debt-to-earnings ratio to decide their creditworthiness. If the those people college loans commonly are paid punctually, it can apply at your spouse’s credit rating, that will feeling a shared application for the loan.

If you do not undertake combined loans otherwise open a joint membership (a charge card otherwise mortgage together, including), the credit shouldn’t be mingled. However, that have a mutual account, differing people is as you responsible for using those individuals expenses. Meaning should your lover cannot spend the money for charge card bill, such, you might be responsible for the whole procedure, though it were not fees you privately accumulated. A belated fee will show on the credit score, regardless if your spouse will pay the brand new costs. People borrowing ding on the the individuals joint levels moves all of their credit scores.

Could you attract more taxation having a wedding?

ount of income taxation you pay. If you have lower income plus partner earns increased money, it’s also possible to get into a top taxation bracket which have a recently combined shape by submitting as you; that’s, your household are treated as a good device.

After you pay even more from inside the fees, immediately after marriage, people phone call one to a marriage penalty. It will be easy, even though, to invest quicker in the income taxes whenever partnered, and is named a wedding bonus.

You will need to consult a tax professional on how delivering married often apply to your income tax rates to help you package in advance and you can understand the new you are able to financial changes that can result.

Before getting partnered, additionally, it is best if you consult a monetary elite concerning implications away from trying out debt for just one partner when partnered additionally the you can effects of you to definitely or each other partners that have obligations prior to relationship. Which have an idea set up to handle the debt, you’ll have a smoother marital transition.