How will my credit score affect my auto loan rates?

- Understand how much you can really afford. Poor credit unfortunately means you’ll be saddled with a relatively high interest rate, so you need to make sure you’re not taking out a loan you can’t afford (interest and all). Use a calculator like MU30’s Auto Loan Calculator to figure out how much you can afford to work into your budget each month.

- Make sure you have enough for a down payment. When you have poor credit, paying a larger down payment can help you have to pay less over the life of the loan and you may be able to secure a lower rate since it reduces the risk for the lender.

- Shop lenders to find the best rates. Shopping around for a few minutes can give you some serious peace of mind since you’ve done your due diligence to find the best interest rate possible. Take a look at the list above for some loan marketplace options which can show you your rates for a variety of lenders all in one place.

- Apply! Once you’ve shopped around all that’s left to do is apply fully for the loan. Like any loan, this will involve offering up a bunch of personal information and signing on the dotted line once you know your rate and have read the fine print (don’t skip this step!).

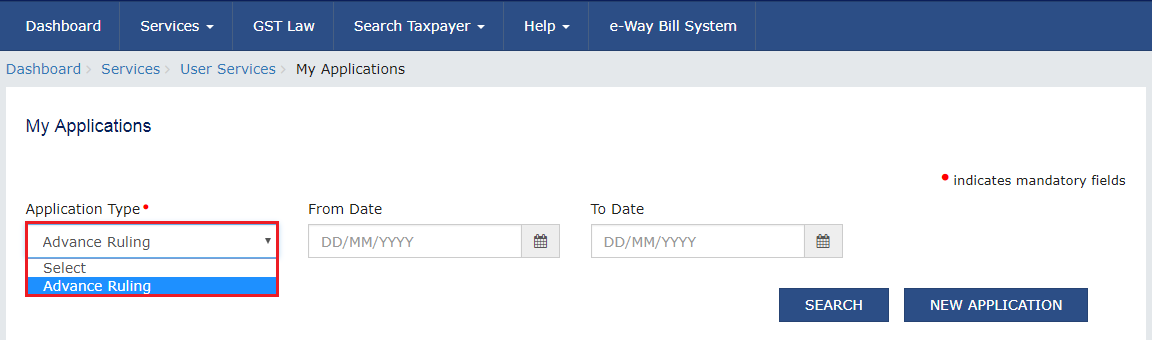

For your own frame of reference, tinker with the Money Under 30 Auto Loan Calculator to see what your rates may be:

What to look for in car loans

Once you start shopping around for an auto loan, what features and aspects should you keep an eye out for?

APR

Naturally, you’ll first want to find offers with the lowest possible APR. APR is supposed to include interest plus hidden fees (it was

Loan amounts

Next, you’ll want to ensure that the lender can accommodate your loan amount, particularly on the low end. If you only need a $5,000 loan, make sure your lender doesn’t have a floor at $10,000.

Term options

36 months is the sweet spot; if you can’t afford monthly payments with a term of 36 months, you probably can’t afford the car. Most lenders offer 36 months as a term, but that’s just something to confirm at the front end. If you can go shorter, go shorter! Look for a lender offering 24-month terms.

Prepayment penalties

Most, but not all lenders will charge you a penalty for paying off your loan early. That’s simply because lenders profit from interest payments, and they want to recoup some of the lost interest from an early payoff.

Prepayment penalties are usually small, like $50 $200 or a percentage of the remaining interest, but if you plan to pay off your loan quickly, it’s worth digging up in your terms and conditions.

Income requirements

Most auto lenders catering to poor credit will require proof of minimum monthly income, ranging anywhere from $1,000 to $4,000 monthly. Unfortunately, unemployment checks typically don’t count since lenders require proof of employment, as well.

Allows cosigners

If you can’t meet the lender’s minimum requirements for income, etc. or you just want to lower your monthly payments, one option is to cosign with a friend, family member, or spouse with a higher income or credit score.

However, cosigning a loan document is no small favor to ask; if you can’t make payments for whatever reason, the lender will start charging your cosigner. So cosigning is an option, but not one you should consider lightly.