How much cash Ought i Availability and How long?

What is actually link funding as well as how will it assist me? It is a question we get normally out-of subscribers therefore we planned to break it down for your requirements in order to learn how it operates, and just how it will hep you.

It’s impractical the earliest domestic you get may be the household you stay in forever. Will eventually, you ought to promote and get an alternative family both so you’re able to revise otherwise downsize or disperse metropolitan areas. And most people need to simply take security off their current home and use it on acquisition of their new household.

Unfortunately, possibly you earn stuck in times where in actuality the closing day into the family you might be to shop for is actually through to the closing go out from your house you happen to be attempting to sell, leaving you versus an advance payment towards brand new home given that it is tied into the equity. Link resource is the equipment accustomed help consumers who get a hold of by themselves in this case.

Hence Loan providers Give Link Capital?

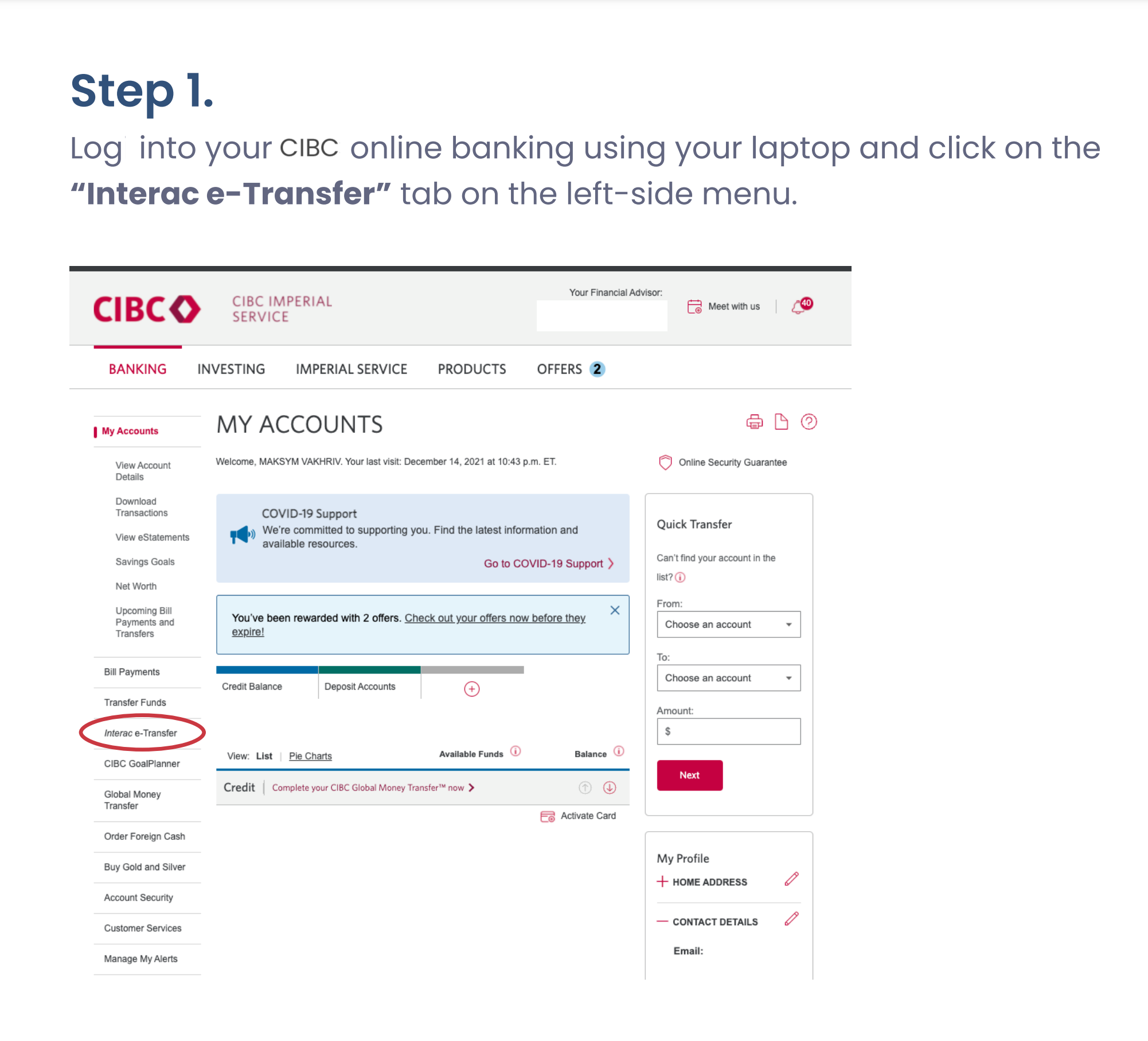

As the connection funds are popular, all the big banking institutions and additionally TD, CIBC, Scotiabank, RBC and you will BMO bring link money on their mortgage consumers. Specific quicker lenders is almost certainly not capable offer you bridge capital even when, so it is usually a good tip to talk about the options that have the large financial company. Not using a large financial company? You really need to it is perhaps one of the most important stages in to order a new family otherwise condominium.

Really

Just how Bridge Financing is actually Computed

Can you imagine the closure time for your most recent home is 90 days away, because closing date for the brand new home is in just thirty-five weeks. A connection loan will cover the collateral along the 55-day period (90 days 35 days).

Like, let’s say youre to buy a great $350,100000 family and also you made an effective 5% put ($350,100000 x 0.05 = $17,500), nevertheless need certainly to lay out new $165,000 out of equity you may have in your existing domestic. The trouble will be your get intimate big date are March fifteenth, in addition to deals of your current household will not romantic up to May tenth. In this situation, you might you need a connection loan with the difference between the deposit along with your complete deposit. Your computation perform appear to be it:

A lot more Charges

Like most loan, a connection loan is at the mercy of attention have a tendency to for a price like an open financial otherwise a beneficial line of credit. Because interest rate on your own bridge financing exceeds the home loan rate always Best + 2.00% otherwise Primary + step three.00% it can only be recharged having a short period of your energy, through to the guarantee from the past house would be open to pay the borrowed funds.

In addition handful of desire you will end up charged, their financial may including charges a condo government fee generally speaking between $200-500. In the long run, as previously mentioned significantly more than, for many who require a larger loan (more $two hundred,000) or that loan for over 120 months, their financial will get sign in a beneficial lien on your property. In order to remove the lien, just be sure to hire and you may pay money for the services of a bona-fide home attorney.

How exactly to Be eligible for Link Resource

Everything you need to qualify for a bridge mortgage try good backup of your Income Arrangement from your current home in addition to Pick Contract to suit your brand new home. Observe that if you don’t have a strong promoting time, you may need to believe an exclusive financial towards bridge financing, because so many banks and you can antique lenders want it.

Complete, connection capital are often used to direct you towards an occasion where your back is generally contrary to the wall its a good idea, even after the brand new charge associated with it, to get your into the dream family.

Wanted facts or help locating the best mortgage broker? Only submit the form less than therefore we can help.