How come Truist assist me accessibility my household guarantee?

The newest sixth-biggest financial in the You.S. after its 2019 merger that have Suntrust and you can BB&T, Truist now offers numerous types of financial, borrowing, financial, financing, as well as individual insurance coverage situations. They operates into the 18 claims while the Region of Columbia.

A lending institution concerned about maximizing organizations and you can improving personal responsibility, Truist’s Community Positives Package sends financial support towards the reasonable- and you will modest-money and fraction individuals. The financial institution helps household heritage effort inside North carolina and you may Georgia and the ones intended for affordable homes, small company increases, and you may nonprofits over the You.S.

Through the years, we provide your residence collateral to enhance as your assets grows for the well worth and field home values go up. Unlike enabling one equity sit untouched, Truist enables you to access it with the aid of a family guarantee personal line of credit (HELOC). You need to use that cash to pay for casual expenses, combine most other loans, pay back a giant get, redesign your residence, plus.

In lieu of a house guarantee mortgage (and that Truist will not bring right now), an effective HELOC will give you an open-concluded credit line to pull out of as needed via your 10-seasons mark period. Immediately following you to definitely mark period comes to an end, their personal line of credit goes into a great 20-seasons payment term, when you can don’t borrow secured on your own collection of credit unless you replace it.

Truist makes it possible for a predetermined-speed identity towards their HELOCs. Using this type of solution, you can lock in a predetermined interest getting between five so you’re able to 30 years.

*$fifty yearly fee is energized if you’re into the Alabama, Arkansas, Ca, Fl, Georgia, Indiana, Kentucky, Nj-new jersey, or Ohio.

Exactly what do Truist’s consumers say about the team?

Its useful to recognize how a financial appears in writing and exactly what points they offer. But how customers have a

Truist’s consumer critiques for the credible websites such Trustpilot and the Better business bureau (BBB) are lacking. Despite their A good+ accreditation to the Better business bureau, the average score of the step 1,800-along with people inside the are step one.11 of 5.

The bank possess a bad rating into the Trustpilot as of , in just step 1.1 stars off a potential 5, averaging out-of more 800 evaluations.

- a long time keep times to-arrive customer service

- frustrations in the solving membership points

- the financial institution establishing for the-time repayments late

Would We qualify for an effective HELOC away from Truist?

Home owners can sign up for a good Truist home guarantee credit line up against their house should they meet certain qualification standards. So you’re able to be considered, you should:

- Bring your HELOC facing a proprietor-filled house, duplex, townhome, or condo (number 1 otherwise additional); money qualities otherwise are made homes are not eligible.

- Features a property situated in among the states Truist attributes (AL, AR, Ca, Fl, GA, For the, KY, MD, MS, NC, Nj-new jersey, OH, PA, Sc, TN, Texas, Va, WV) otherwise Arizona, DC.

- Meet Truist’s credit rating, money, and you can mortgage-to-well worth (LTV) standards. (These may will vary by condition as they are maybe not uncovered.)

How to pertain with Truist?

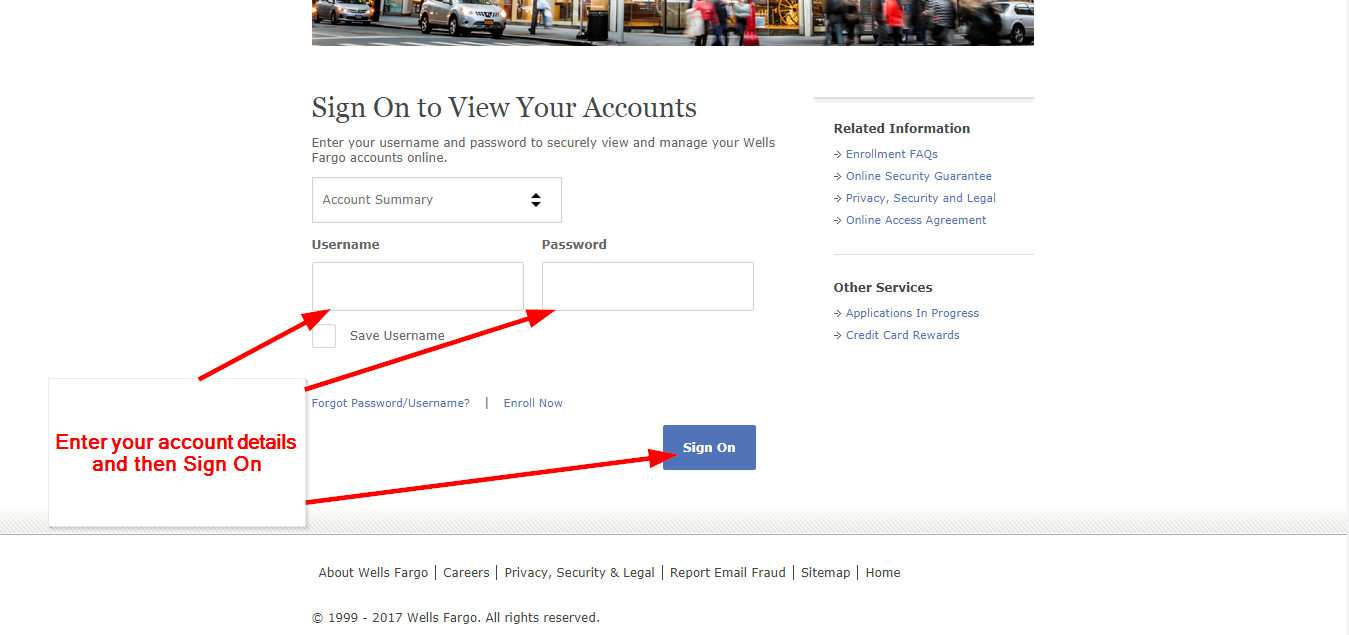

Anticipate to invest regarding the 20 minutes completing the web based app. The borrowing from the bank actually pulled unless you click submit in your app, in the event that financial performs a good hard credit check. This provides the bank entry to the full credit history, and it also profile brand new inquiry on the credit reporting agencies.

Since the Truist doesn’t render soft credit inspections or prequalification to have HELOCs, price searching and you will researching loan providers could be more hard. A soft credit check offers a loan provider accessibility a finite credit score instead of reporting a difficult query which knows if you’re likely to qualify for an effective HELOC and you may exactly what words they can offer.