How can i determine if I am entitled to an effective USDA loan?

This new eligibility criteria depend on the type of USDA mortgage. We have found an overview of some of the well-known eligibility standards to own one another software, however, there may be most criteria and you can restricted conditions.

USDA structure loan requirements

You happen to be able to use an effective USDA protected financing to purchase property and create a home, along with standard and are formulated property, in lieu of to find a current domestic.

General standards and qualification are the same for the USDA secured financing system if you buy otherwise create property. But not, you may need to run an approved company while the design will need to be inspected and you can see specific advice, like energy savings building codes.

Both, someone get a property financing immediately after which re-finance your debt with a home loan shortly after their house is ready. The new USDA secured loan system now offers a combo structure-to-permanent financing, often referred to as just one-personal mortgage, that enables you to submit an application for as well as have one mortgage having the entire process. In that way you don’t have to deal with trying to get a second financing otherwise spending most settlement costs in order to refinance.

You will be able to make desire-only payments in the design and then the loan turns into a thirty-12 months home loan. Or, create complete money built right away. You could remark brand new USDA’s variety of acting loan providers about construction-to-permanent loan program if you’re selecting one among them fund.

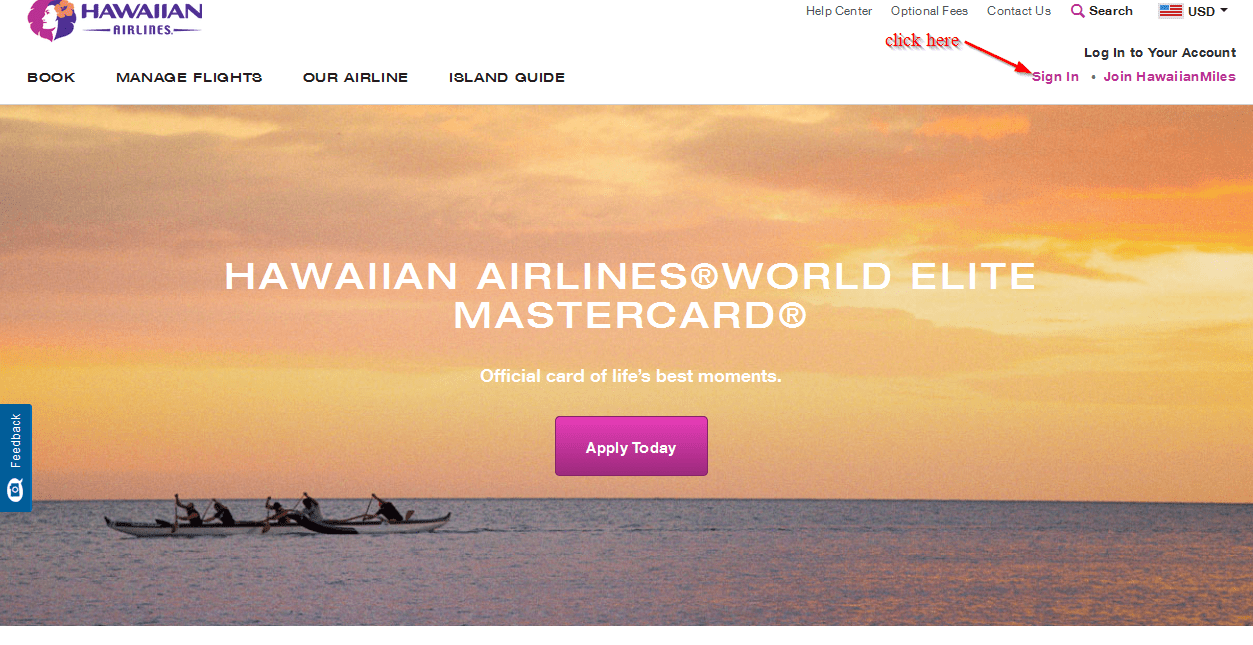

You should use the newest USDA’s notice-review equipment to find out if you happen to be entitled to an excellent USDA loan and you can whether the assets or house you are looking for is in a qualified town:

For every single analysis have several different tabs which you can use to search a speech to locate be it eligible and to dictate your earnings restrictions based on the location, household proportions, and other standards.

It may become once the a shock, but there are land during the residential district portion which can be USDA eligible along with very rural towns and cities, says Boies. A relative has just purchased property just outside the urban area limits out-of Rod Rouge, Los angeles, and their home is in an eligible urban area.

USDA home loan cost

USDA money usually offer lower cost than just traditional money. Search below evaluate average costs-once the monitored of the home loan analysis and you will technology company Optimum Blue-to track down a thought exactly what the market’s such as for example. However, be aware that the rate you may nonetheless depend on the lender and you may creditworthiness, so it is worthy of shopping around for the right home loan company having your role.

Options to a USDA financing

Even in the event good USDA loan are a great fit for the majority of anyone, you might not meet the earnings standards or should live during the a qualified area. Check out option style of mortgages, such:

- Antique money: Mortgage loans that are not section of a federal government program. These may wanted step three% so you’re able to 5% down, nevertheless must place no less than 20% down seriously to stop investing in home loan insurance rates. You want a 620 minimal credit score so you can qualify.

- FHA finance: Government-supported money granted of the individual lenders and you will guaranteed of the Federal Construction Administrations-one fundamentally want a credit history away from five hundred+ which have an excellent 10% down payment or a get out of 580+ that have an effective step 3.5% minimum down payment. FHA finance have home financing top one can last for the newest life of the mortgage if you put lower than ten% down. For individuals who lay 10% or even more down, it is possible to still have to purchase the fresh MIP, but could apply to get it got rid of shortly after making on-big date payments for eleven ages.

- Va finance: If you are a qualified You.S. armed forces service representative or veteran, good Virtual assistant financial might possibly be a good option. The same as USDA guaranteed funds, Virtual assistant loans don’t need a down payment, but you might have to spend an initial money commission.