Have you been Becoming Overcharged in your Navient or Sallie Mae Pupil Financing?

Regardless of this allege, as 2013, the businesses has apparently calculated attract for the student loans slightly in different ways-and you may of course within like if you’re charging higher attention than promised

Sallie Mae, built from inside the 1973, inserted a beneficial merger off kinds that have Navient in 2014. Navient got more than Sallie Mae’s government financing repair company, and from now on covers battery charging and you can repair on the millions of government pupil loans. Sallie Mae also provides private college loans being later on securitized, or separated and you can offered to help you buyers.

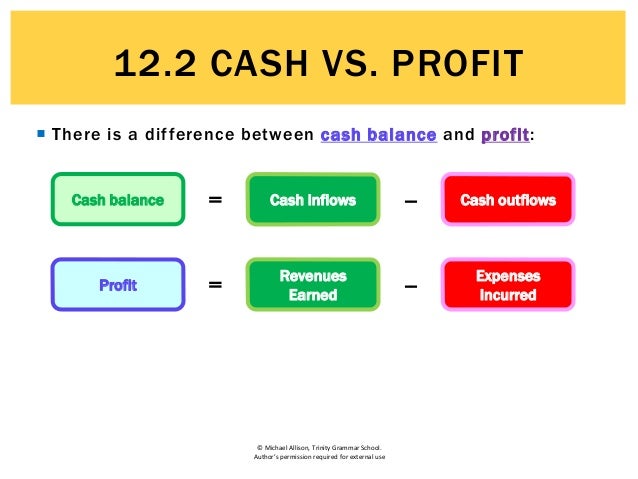

Both people has in public areas said that the interest with the education loan obligations is dependent on days per year. This miscalculation keeps lead to users whom currently challenge according to the pounds of figuratively speaking paying way more in their monthly payment than just it legitimately are obligated to pay in both notice and you may later costs.

Just last year, Sallie Mae and the authorities achieved an agreement pursuing the nation’s largest education loan lender is accused regarding cheating student loan borrowers. Sallie Mae are purchased to pay $step three.step 3 billion inside penalties and fees, also to refund around $30 million during the later fees. The company was also ordered because of the Consumer Economic Defense Bureau to spend $96.6 mil inside the restitution and you can penalties to possess incorrectly running monthly scholar mortgage payments.

- Sallie Mae attempted to cover up illegal financial strategies from inside the broke up so you can Navient.

- Sallie Mae borrowed a whopping $8.5 million within 0.23 per cent notice regarding the Government Mortgage Financial inside Des Moines. The cash is actually earmarked in order to originate the personal figuratively speaking. The business wound-up placing more $2.5 mil in their pocket by loaning the cash off to pupils within 25 to 40 minutes the speed it paid.

- Even though such student loans take into account just 23 percent of its profile, Personal Training financing be the cause of almost sixty percent of one’s businesses net gain away from desire.

- From the declining to greatly help student loan borrowers who happen to be from inside the financial issue with almost every other payment choices, Sallie Mae actually preserves Place for ADShundreds of thousands during the potential costs.

- By the not wanting to utilize education loan consumers, Sallie Mae stands and then make higher still profits afterwards just like the debt cannot be released using bankruptcy.

- A ca group step suit against Sallie Mae/Navient so-called the five percent late payment charged each missed commission on the a personal student loan is equivalent to a yearly interest rate from 120 per cent.

- As well as the extreme later costs, Sallie Mae together with fees borrowers regular appeal toward skipped percentage number, fundamentally inducing the borrower paying twice if you are later on a single education loan payment.

- Accusations against Navient said the business violated state regulations banning unfair otherwise abusive methods. They performed that it by paying the call centre professionals centered on how fast people experts might get education loan consumers from the phone.

- Navient inappropriately steered hopeless individuals on the preparations and that briefly deferred money, yet invited mortgage balances to grow.

Sallie Mae became a switch pro inside 1995 inside education loan securitization- packaging student education loans. In the event the regulators set a halt in order to individual loan providers making pupil loans that happen to be protected by the government, Sallie Mae diversified to your Cds, high-give offers membership, credit cards, insurance rates services examining profile. In occasions in which student education loans was in fact becoming repaid later, Sallie Mae went on to create into the money as a consequence of their own personal debt meeting enterprises, Pioneer Credit Recuperation and you may Standard Money Corporation.

You are investing much more about their student loan than simply you want to Sallie Mae and you can Navient

Golomb Legalis exploring Sallie Mae and you will Navient for charging extreme numbers of great interest, causing users purchasing more it truly are obligated to pay. Because the change might not be grand for 1 borrower, those individuals distinctions could add doing many inside deceptive earnings to possess Navient and you may Sallie Mae.

If you believe you’ve been overcharged attract on your own scholar loan debt, we are able to let. To learn more about your legal alternatives or perhaps to agenda an effective totally free visit, label Golomb Legaltoday within (215) 278-4449. We portray clients when you look at the Pennsylvania and on the You.