Everything you need to Realize about To find a home After you Has actually Student loan Obligations

It’s really no wonders that education loan personal debt can also be set a life threatening damper on

So, should you decide manage student education loans immediately after which pick a property? Just be sure to do it at the same time? Concentrate on the house basic?

Determine whether to get a property can make monetary feel

Even before you consider ideas on how to purchase a house after you enjoys education loan loans, you have got to decide whether it is reasonable economically to get or if perhaps it’s a good idea to save leasing.

If all about debt existence existed equivalent, how long wouldn’t it elevates to keep having a down percentage? Let’s carry out the mathematics.

The newest average home price getting a first-day visitors in 2017 try $182,500, so that you need save yourself $thirty-six,500 when you need to possess a beneficial 20% down-payment. If you would like buy your domestic within the next around three ages, you have to be saving $1,014 a month.

How much time does it take you to invest your student education loans?

If you are searching at the same three-year several months, how much time will it elevates to blow your student education loans, and exactly how far can it prices?

The average student loan personal debt was $twenty eight,950 in the 4.29%. At this rates, you’d have to pay $ a month for three decades to help you fully outlay cash away from.

Therefore, for those who have $step 1,100000 available to put aside per month, you must decide what their concern was: to order a property or using their education loan?

Search on the cost of owning a home in your neighborhood immediately after which have fun with the book compared to. purchase calculator to see if it’s minimal to expend an effective month-to-month financial or month-to-month book. Do not forget to reason behind most other expenses associated with buying a great house, just like your homeowner’s insurance policies, crisis maintenance money, and you will any HOA costs.

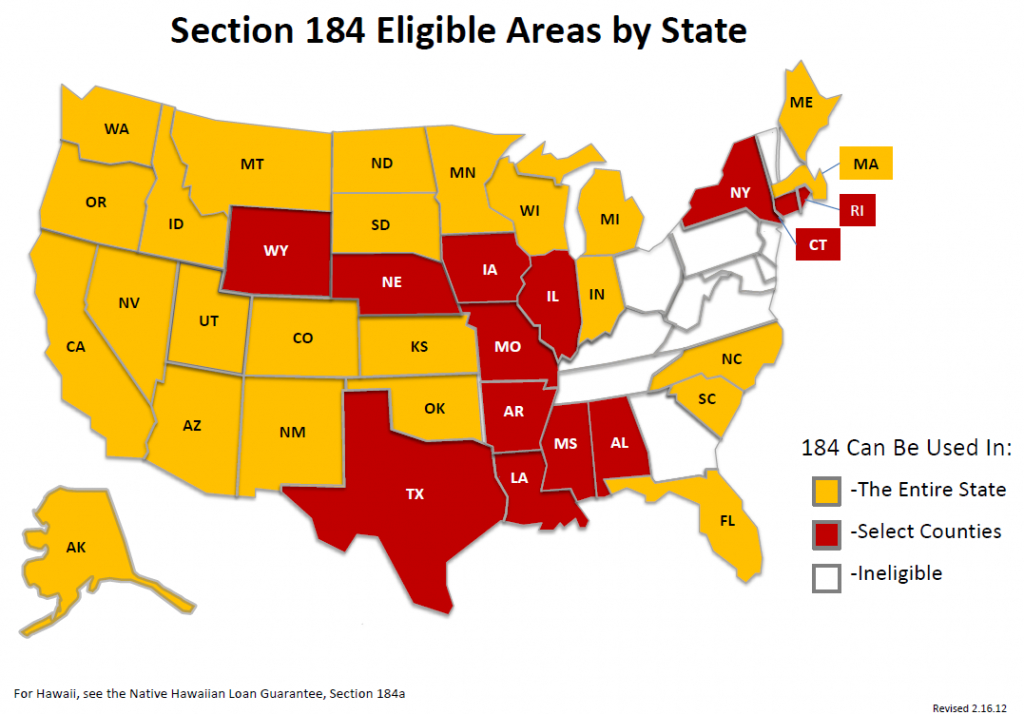

When it is cheaper having property together with the relevant expenditures, it would-be time and energy to begin looking on the options such as for example an FHA financing or other first-time household consumer system. This type of software helps you become a citizen sooner by eliminating what kind of cash you prefer having an advance payment. Then you can make currency it can save you on the lease for each times and you will add you to on the student loan commission to simply help outlay cash down less.

Almost every other monetary you should make sure

Like most monetary choice, purchasing a property or investing your own student education loans isn’t really black otherwise light. Make certain you will be together with capable save money for your disaster finance, that can defense people significant medical costs and other unanticipated expenditures, please remember your retirement deals.

Start planning your purchase

Okay, so you went the brand new wide variety and from now on ‘s the correct time on the best way to get, student loans be darned! Here is what you need to be contemplating.

Put a target

You don’t have a massive nest egg best away regarding university, so that the first faltering step inside the to acquire a house try setting an excellent objective right after which and come up with a plan to go they. Examine internet such as for example Zillow otherwise Trulia to see exactly how much home near you costs. Calculate exactly how much might requirement for a great 20% downpayment, after that use our very own financial calculator to see exacltly what the monthly installments might be and exactly how far domestic you could potentially most pay for.