Debt-Integration Refinance: Make use of your House Security to settle Personal debt and you can Save money

Even if you enjoys a decreased rate on the financial, do you have the skills far you will be purchasing in the interest each month for your handmade

Managing expenses with a high rates of interest can seem to be such as for example an uphill race. Monthly personal debt repayments control a big amount of the money, and it may feel it entails permanently to pay off the amount you borrowed. And with rising prices and you may interest rates however increased, more folks are accumulating balance and losing trailing on their monthly personal debt costs.

Taking power over your finances and you can cutting loans can also be greatly reduce worry and gives a feeling of monetary versatility. When you find yourself overwhelmed which have multiple expenses, a debt settlement refinance helps you combine your own expenses and make clear your financial loans.

Why don’t we mention just what a debt consolidation refinance is and exactly how your can use they to help you safer a powerful monetary upcoming.

Why does a loans-Integration Re-finance Functions?

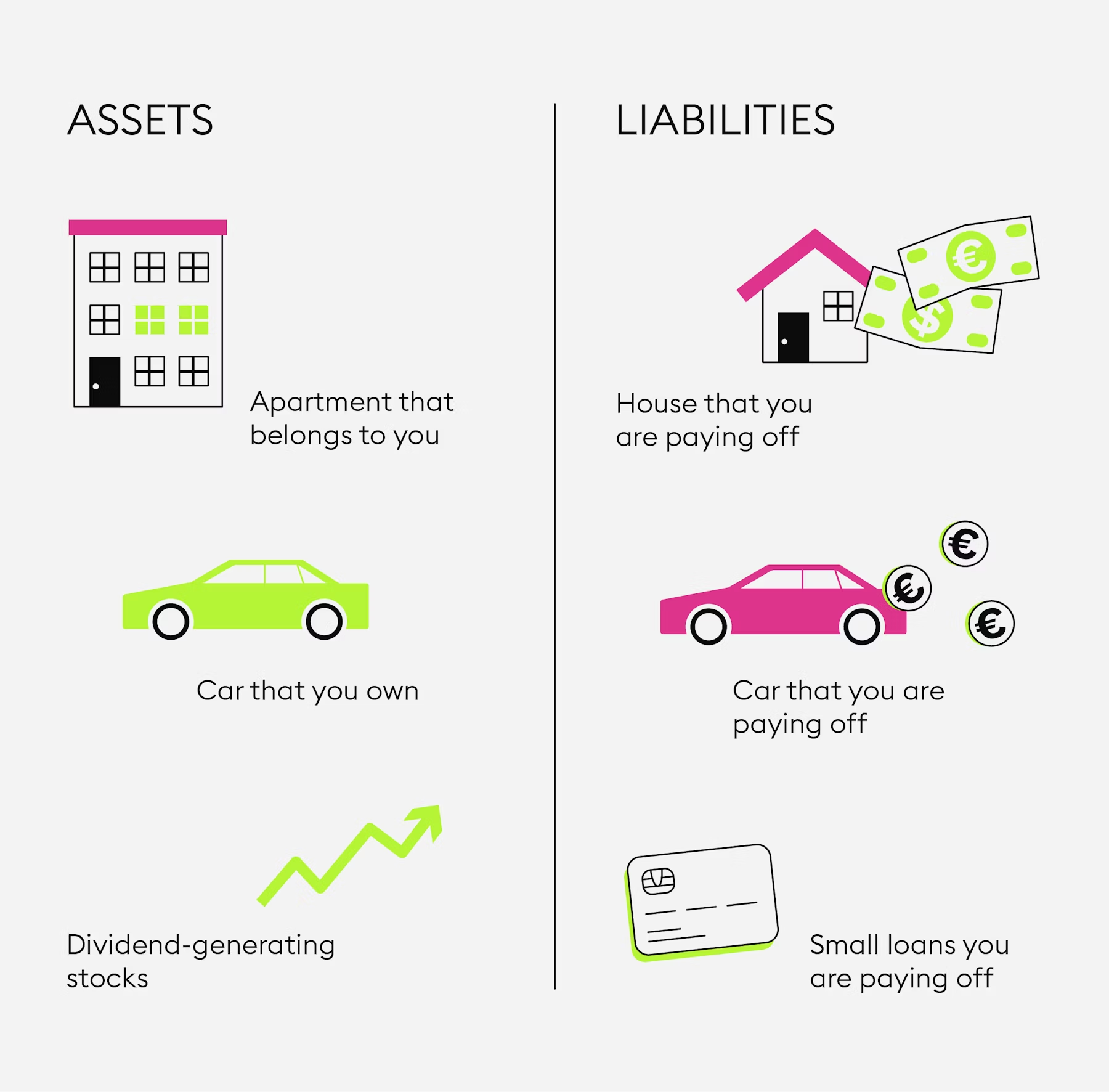

Understand how it performs, we should instead talk about equity. Collateral ‘s the difference between what you owe on the mortgage as well as how far you reside worthy of. An obligations-integration re-finance allows you to make use of your own made equity to help you access bucks and you will pay off financial obligation.

The following is good hypothetical disease: you purchased a property to possess $two hundred,000 which have an excellent $180,000 loan. 5 years enjoys introduced, and from now on you borrowed from $160,000 towards mortgage. Our home comes with enjoyed that will be now worth $3 hundred,000, you has $140,000 in the equity.

Really loans-combination (otherwise cash-out) re-finance software enables you to accessibility to 80% of one’s collateral, thus in this instance you would be capable located right up in order to $112,000 to settle some other debt balance you have (auto loans, credit cards, medical expenses, figuratively speaking, etc.). This type of debts is actually basically wrapped in the mortgage, causing an individual payment.

Do a personal debt-Consolidation Re-finance Indeed Save a little money?

Regardless if home loan pricing was hanging regarding the seven% variety lately, mortgages are among the many most affordable a way to use money.

Repaying your personal credit card debt who has got 20% appeal otherwise your vehicle mortgage who’s 11% interest will save you excessively money and lower your own costs. Mortgage personal debt is even secure and it has a predetermined rate of interest, which means that your commission is the exact same throughout the years compared to the credit cards costs that’s variant and you may ingredients dependent on exactly how much you opt to shell out per month.

It is very important keep in mind that this doesn’t build your debt fall off. Youre however paying it off, close to a lower rate of interest. This will save a little money and alter your monthly cashflow by detatching extreme debts. Yet another cheer is that financial appeal is generally tax-allowable if you find yourself most other personal debt is not.

Make sure you remember From the Closing costs

Be sure to know just how closing costs play into the decision. Settlement costs was bank charge and you can third-group costs you pay when delivering home financing. You must pay such into the an effective re-finance as if you performed on your own totally new mortgage.

Closing costs are very different however, will usually getting multiple several thousand dollars. While you are these types of can cost you is commonly rolled into the this new financial rather than repaid which have a lump sum of money (also called a zero-closure cost refinance), might enhance your current personal debt balance. This is exactly money that may probably wade into the repaying your own current bills.

To decide in the event that an obligations-integration refinance was economically of use, you must weighing this type of closing costs against the total interest savings you stand-to gain regarding combining your debts.