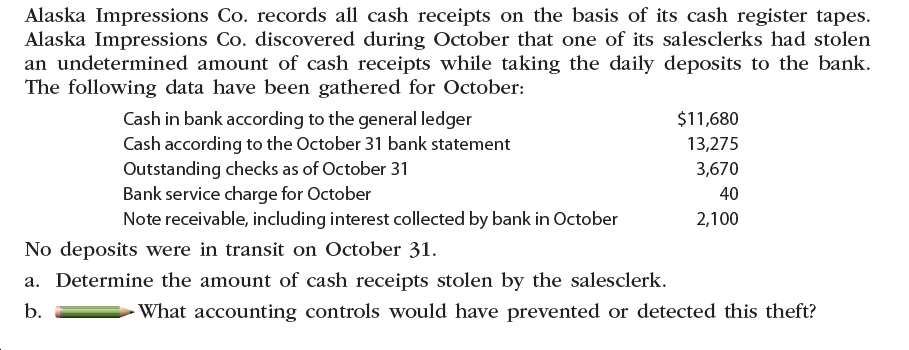

Cashing your 401k or getting an effective 401k loan: What you need to understand

Whether you are given cashing your 401k or getting a great mortgage from it, look at this information so you’re able to generate an informed choice.

Shortly after years

401k financing

If you are considering financing out of your 401k plan, consider their employer’s decide to confirm for those who can be acquire of it. Check out what to remember.

- 401k loan restrictions. For most preparations, brand new Internal revenue service claims «the most that the bundle can be permit because the financing is actually either more regarding $10,000 or fifty% of the vested balance, otherwise $fifty,000, almost any is actually smaller.»

- 401k loan fees laws. You will find standards to have repayment off an excellent 401k loan. Very first, the money has to be paid off, usually over good five-12 months several months. For people who end, was let go or if brand new 401k package try terminated, the borrowed funds often typically be due in this two months. This is often a large economic strain on your on top of that so you’re able to form right back retirement rescuing. A different disadvantage is when the loan is not paid off whenever owed, then financing equilibrium would-be managed because the a withdrawal and you will tends to be at the mercy of income tax in addition to an effective 10% punishment income tax while you are more youthful than simply 59? yrs . old.

- 401k loan focus. You will have to afford the cash back that have notice, which in most cases could be less than focus charged at the a lending institution otherwise playing cards. Thankfully, the interest was credited for the 401k account, to not ever your employer, so that you is paying the cash back so you’re able to oneself. Paying the mortgage back will come correct out of your paycheck, as well. Thus remember that this will reduce your need-family spend through to the financing are repaid.

Cashing your 401k

It can be tempting when planning on taking the major lump sum payment off your 401k once you hop out your task and set it with the both hands instead of running it more on yet another 401k otherwise IRA. But it’s important to comprehend the income tax consequences when you decide going you to route.

401k rollover

When you hop out your job, you could bring your 401k to you. For folks who roll over your own 401k balance with the an enthusiastic IRA or your brand new employer’s later years package, your money will continue to grow to possess old-age. A primary rollover practically function you are going to roll the cash out-of that account to a different, without the money are directly in your own hands through the exchange.

401k fees

Unless you’re 59? or elderly, you’ll generally have to pay income taxes for the fund taken and additionally a great 10% punishment taxation. That will make detachment very costly.

If you’ve kept your boss and so are over-age 59?, you’ll not face the ten% federal income tax punishment by firmly taking your 401k balance since a beneficial taxable shipment. You are going to need to pay taxation towards the full amount taken unless of course a portion of the loans try Designated Roth Benefits. While you are nevertheless employed, the master plan may maximum distributions of account balance in the event youre ages 59? or older. Contemplate seeing their tax mentor before taking a nonexempt shipment from the 401k package.

Required minimal withdrawals (RMDs), beginning in April following the year your change 72 (70? if you were 70? prior to ), is important for people harmony kept in the new 401k bundle.

401k difficulty detachment

Particular 401k agreements can get enables you to withdraw funds from your senior years in the example of pecuniary hardship. This type of difficulty shipments should be due to a great big and you may immediate financial you prefer. As well as the total end up being withdrawn is limited from what are wanted to match the you desire.

- Medical costs to you or your loved ones.

- Expenses about the purchase away from an initial quarters, excluding mortgage payments.

- Tuition and you will related instructional charges and you will costs for family members.

- Expenses away from a declared emergency.

- Money necessary to prevent eviction from, or foreclosures to the, a main home.

- Burial or funeral costs to possess a spouse otherwise depending.

- Particular expenditures toward resolve from problems for your own principal household.

Yet not, your boss may decide for everybody, certain or not one of those should be eligible for adversity distributions about 401k package. And additionally, for people who located a trouble withdrawal regarding 401k bundle, you will possibly not manage to sign up for your account to have half a year. And you will number taken can’t be paid down towards plan. These withdrawals will normally getting subject to each other income tax and you will good 10% taxation punishment (to possess members less than many years 59?), thus think it over given that a past hotel having a serious crisis.

Unstable things in life such as for instance making your job, that have personal debt or feeling a condition get cause you to score that loan, cash-out and take money from their 401k membership. However, contemplate it only after you’ve worn out finances savings membership. You are better off shopping for other sources of income otherwise yet another financing kind of. This way, you could potentially help in keeping retirement money safe for the real mission, old-age.

All the info in this article try taken from individuals supply not of State Farm (together with State Ranch Common Auto insurance Providers as well as subsidiaries and you can affiliates). Even as we believe it getting reliable and you can appropriate, we really do not warrant the accuracy otherwise accuracy of the advice. County Farm is not guilty of, and will not promote otherwise agree, often implicitly otherwise explicitly, the content of any third-team websites that would be hyperlinked out of this web page. What is not designed to replace guides, directions otherwise pointers provided with a manufacturer and/or suggestions away from an experienced top-notch, or even to connect with publicity under people applicable insurance plan. These tips aren’t a whole list of all of the loss manage scale. County Ranch renders no claims away from results from entry to it suggestions.

Before running over possessions of an employer-paid advancing years plan for the an enthusiastic IRA, it’s important that users understand its choices and you can would a complete assessment to the variations in the fresh pledges and you will defenses provided by for every respective sort of membership and the variations in liquidity/money, variety of investment, charges, and you can any potential penalties.

Condition Ranch Life insurance policies Organization (Not signed up for the MA, Nyc or WI) State Ranch Lifestyle and Collision Assurance Providers (Subscribed in the New york and WI) Bloomington, IL