Aggressive Rates of interest: USDA loans have a tendency to feature all the way down interest rates compared to conventional mortgage loans

Scissortail Financial now offers USDA money for the Tulsa with zero advance payment and you can aggressive rates. We’re going to make it easier to browse the procedure easily.

What is actually good Tulsa USDA Loan?

A good Tulsa USDA mortgage try a specialized financial program built to assist reduced- to help you average-earnings group in the to invest in property situated in qualified rural and suburban section. Backed by the united states Institution out of Farming (USDA), these types of funds offer multiple distinctive line of professionals, and also make homeownership far more available just in case you meet the requirements.

Zero Downpayment: One of the most significant benefits of a great USDA financing are that you could finance to 100% of one’s house’s price, reducing the necessity for a down-payment. This feature renders homeownership even more attainable for the majority people exactly who can get not have big discounts to own a vintage downpayment.

Reasonable Mortgage Insurance rates: The borrowed funds insurance fees regarding the USDA finance are usually down than those getting FHA otherwise conventional financing. This helps to store monthly payments in balance and you can reduces the complete cost of borrowing.

Flexible Borrowing from the bank Criteria: USDA funds provide a great deal more lenient credit criteria as compared to a number of other financing models. Which independence can make it easier for individuals that have quicker-than-perfect borrowing from the bank to help you be eligible for a home loan.

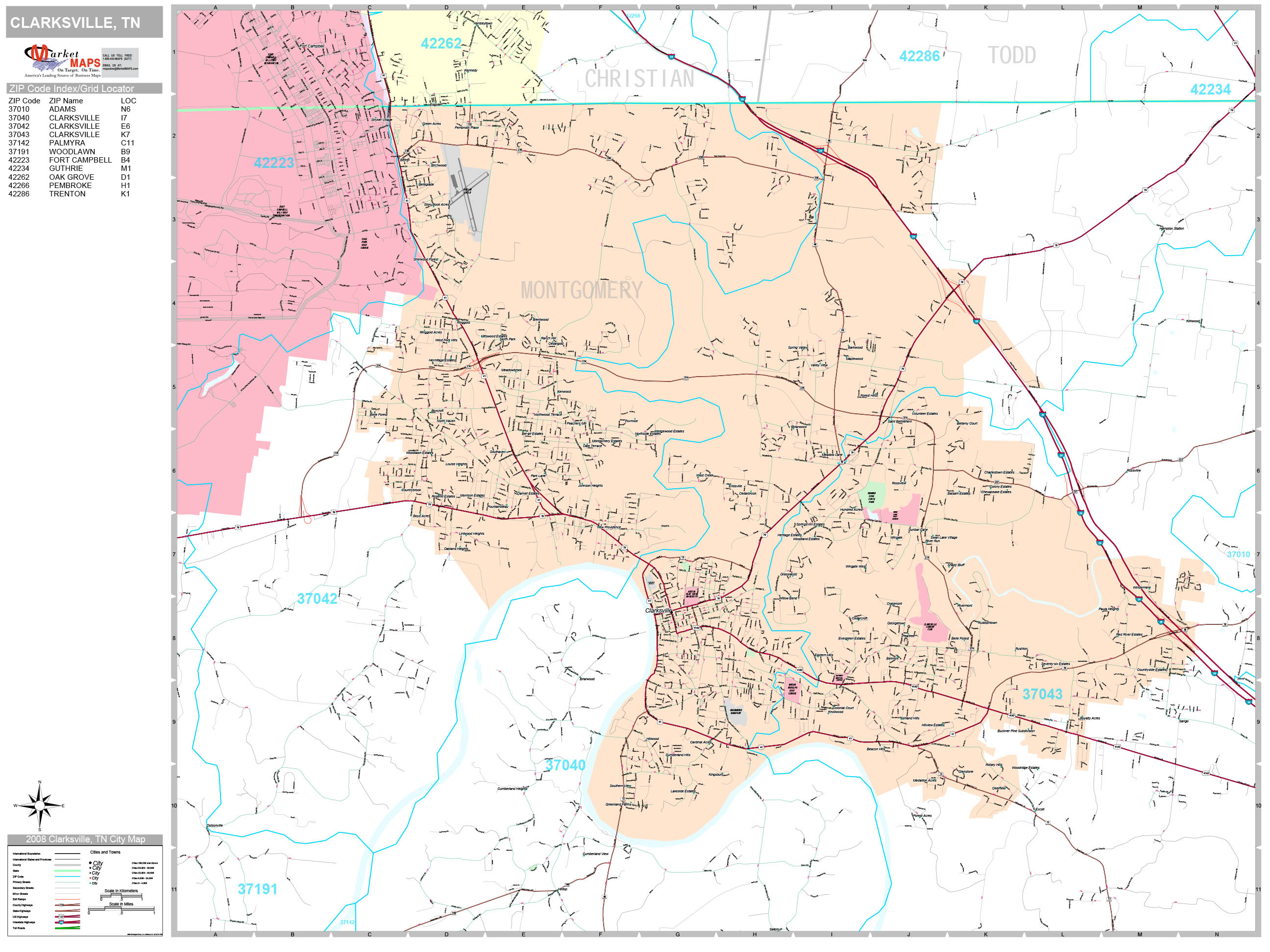

Geographical and you will Income Limits: To help you qualify for a good USDA mortgage, the property must be located in a qualified outlying or suburban city because laid out by USDA. On the other hand, people need to fulfill certain money criteria, which can be normally according to research by the average earnings to your town and you will modified to have domestic proportions.

Full, a beneficial USDA loan shall be an excellent option for qualifying homebuyers when you look at the Tulsa that are looking to purchase a property during the an effective rural otherwise suburban form while taking advantage of positive loan words.

Tulsa USDA Mortgage Requirements

To help you qualify for an effective USDA mortgage inside Tulsa, consumers must satisfy multiple trick criteria oriented because of the USDA and you will individual lenders. This is what you must know:

Money Limits: Your revenue must fall during the USDA’s appointed restrictions for the town and you will household members dimensions. These limitations are designed to guarantee the system facilitate low- in order to modest-income family members.

Credit history: A minimum credit score of about 640 are well-known. Because the USDA doesn’t place a rigorous minimal, loan providers could have their standards.

First Quarters: The property you are to purchase is employed since your number one quarters. USDA financing aren’t readily available for financial support attributes or second belongings.

Possessions Qualification: The house have to be located in an eligible rural or suburban city as the defined of the USDA. Metropolitan characteristics aren’t qualified to receive USDA investment.

Debt-to-Income Ratio (DTI): Generally, a beneficial DTI ratio regarding 41% or shorter is advised. So it ratio actions their total monthly debt repayments against your gross month-to-month earnings.

A career Record: Loan providers constantly want at the very least 24 months out-of consistent a position. That it shows balance therefore the ability to would mortgage payments.

Conference these types of requirements makes it possible to gain benefit from the benefits provided by USDA fund, such as for instance no down-payment and aggressive interest levels.

Tulsa USDA Financing Earnings Limits

Having 2024, the fresh new USDA has created particular earnings limitations to possess being qualified to own a great USDA loan during the Tulsa, showing a rise on the early in the day season. This type of limitations make sure the system experts lowest- so you’re able to reasonable-money property. Here you will find the updated income restrictions:

Homes of just onecuatro Some body: The income maximum is decided on $112,450. That it stands for an increase regarding the earlier in the day year’s maximum regarding $110,650.

This type of earnings thresholds are designed to match some nearest and dearest sizes and you will earnings account, and also make homeownership a lot more accessible having a bigger set of people. Conference this type of restrictions is a must to help you be eligible for a great USDA financing, which provides masters such no down payment and you can competitive notice pricing.