A mortgage manager try an individual who requires mortgage software, and covers prices and you may terminology with prospective borrowers

What’s that loan Officer?

Financing officer is actually an individual who takes applications and offers rates, costs, and you may terms and conditions about your mortgage that you are trying to get.

Very MLO’s or home loan officers is actually licensed to run inside the official they work within the. But not, real estate loan officers who work having FDIC finance companies are not needed to track down a license.

If you wish to get a mortgage then you’ll definitely need to work at a loan manager to carry out very.

An excellent mortgage administrator will assist you to find the correct mortgage variety of and you may financial terms. They are going to help to help keep your loan inside your budget and won’t tension one feel even more costs or invest more you are at ease with.

It is essential to mention this simply because of many financing officers, particularly for larger on the internet businesses are simply sales agents. It know specialized scripts most of the built to make you concur to use them even in the event the pricing and you may fees are expensive.

We think its very important to partner with an individual who was regional to you personally and you can know your state, city, or town. If the mortgage officer is actually providing Boiler Place vibes, it would be time to consider utilizing other people.

Precisely what does a loan Manager Manage?

If you’ve never ever ordered a house prior to, the complete processes can be a bit jarring. For the majority

Providing home financing are way different than to get a motor vehicle. The procedure takes much longer, the level of documents required is a lot more, together with standards are different.

Having individuals having good credit, to purchase a car or truck is as easy as take a credit history and finalizing paperwork. Little or no data files is amassed, and you are on the road.

When buying a home and obtaining a home loan, no matter whether your credit score try 800 otherwise 600, the level of data you must provide is the same.

This is because your credit score is considered the most only about three important factors one to determine what you be eligible for. The other a few are your income and your assets, all of and that want files to verify.

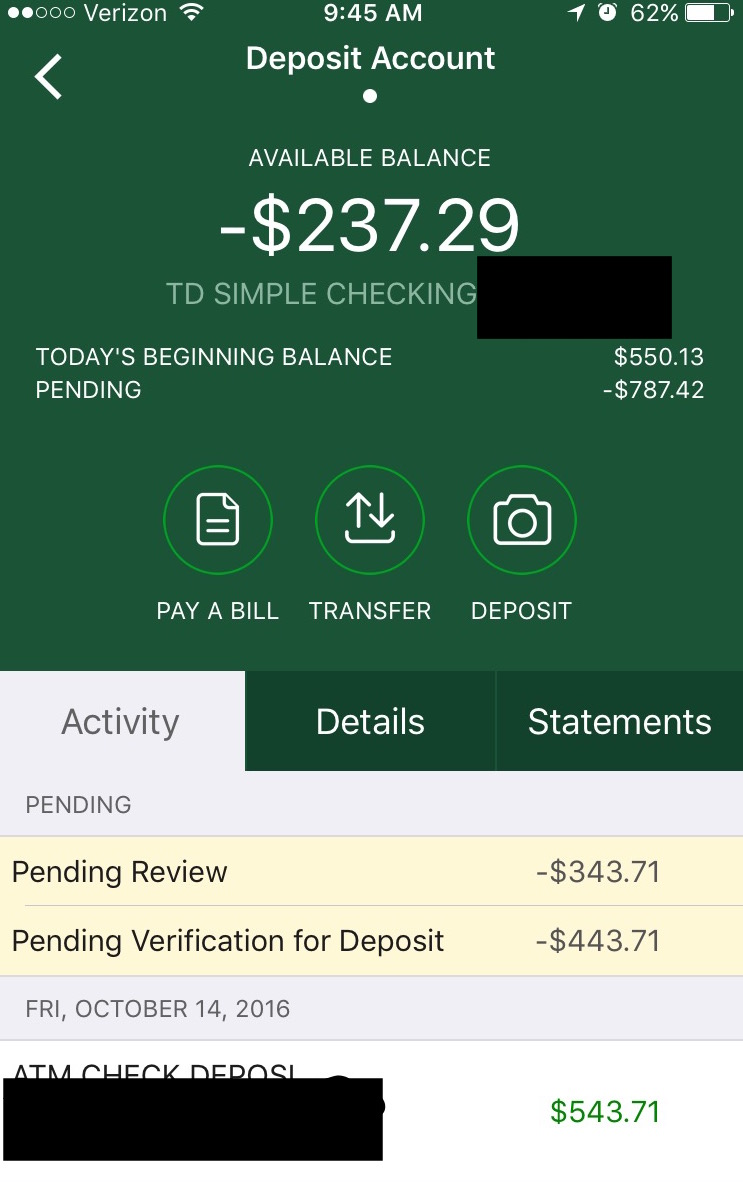

Very although your loan manager could be asking good ton of private inquiries, asking for things like the paystub, taxation statements, and bank statements, he or she is an advocate for you.

An advocate For you

An excellent mortgage administrator is but one who’s advocating for your requirements and not the financial institution. Since LO have an obligation towards financial and work out sure that there’s no scam, the loan officer is always to put your requires over their unique.

You will want to remember that since your financing manager is a suggest for you, don’t cover up one thing from their store. The borrowed funds process is very expert. If you attempt to full cover up such things as your revenue, where your loans are on their way off, or anything else, the process is thorough adequate to discover it.

The problem is that it’s not often exposed until you’re personal to help you closing the loan and now have currently spent time and money towards the process. Thus end up being clear together with your financing manager because it’s their job to get you to the newest closure table.

Bring your Loan application

To begin with your loan officer will do are take your loan application. This can be done actually, over the phone, otherwise what is actually most commonly known is online. The mortgage software is extremely thorough, and it is important to be truthful and you can comprehensive once you over it.