5 Questions to inquire about your own Prospective Home loan company

Whenever you are looking for to invest in property and are also willing to explore financial alternatives, your regional home loan company will probably be your wade-to people. But, if you’ve never ever applied for a mortgage ahead of, you will likely has multiple inquiries to ask them regarding the loan processes.

Brand new Warranty Bank Financial team will be here working their hardest to you personally, therefore, the considerably more details you come equipped with, the simpler its to allow them to find a very good mortgage

Will you be needing to pull My personal Credit rating?

When you are first finding a property and you will sharing financing possibilities, the loan administrator will need to perform a painful remove out-of your credit score locate your interest rate. But not, it is important to consult with them once they will perform this as it arise on the credit file. When you’re searching numerous loan providers and you can evaluating their functions, you’ll want to discuss that it together to attenuate the danger for the credit. Credit scores accustomed influence real estate loan behavior can vary everywhere off 300 900, towards highest numbers being more appealing to financial institutions. Your credit rating will teach the financial institution the reputation for and then make payments punctually, which can only help all of them influence the kinds of finance which you normally qualify for.

An advance payment is a fees that is generated towards financing till the financing starts. A bigger downpayment assists shed the amount borrowed and you can can be for this reason reduce your monthly obligations. During the a perfect disease, this could be 20% of the property price. Although not, you really have loads of alternatives. Specific mortgage software do not require a down-payment, although some require a significantly shorter down payment. You can even consult with your loan administrator from the borrowing having the fresh new percentage having fun with a different sort of house you possess as equity.

Note: Either extent that you use having a down-payment commonly and additionally connect with if you wish to spend mortgage insurance policies or perhaps not. Make sure to talk with the borrowed funds officer so that you are prepared for your financial insurance fees at the start!

What is the Interest?

Rates change reliant numerous financial affairs. According to what kind of loan you are considering, your instalments you may stay at a predetermined rates, or a variable price throughout the years. Its must appreciate this in order that there are no unexpected situations. Into the a predetermined rates home loan, the rate stays repaired in the everything begin in excess of the whole longevity of the loan. However, in a changeable speed home loan (ARM) the interest rate you will change upwards or down established just what the pace is at the end of a specific several months of energy. Once you speak to your mortgage officer on securing inside a keen rate of interest, please note you to definitely Guarantee Financial costs no costs to own locking the new price to you personally, together with rate can stand closed for approximately forty-five days.

If you’d like an effective ballpark a number of that which you interest rate could well be, have fun with our form to evaluate their rate of interest as well as have a beneficial estimate on the web!

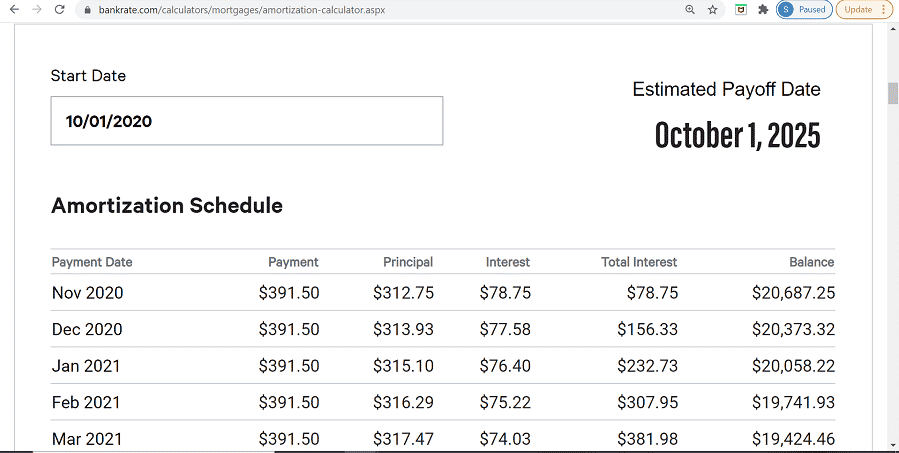

Perhaps one of the most essential bits of important information to help you understand is when much you will be paying per month to ensure that you might be certain that they fits affordable. Go to all of our mortgage monthly payment calculator (your location and in a position to incorporate taxes and insurance coverage) to get a far greater understanding of how much we provide to pay each month. This product might show you the primary and interest broken off established the modern rates of interest.

Next to monthly installments, of numerous mortgage individuals ask about prepayment fees to have settling their financing in advance of its owed. Guarantee Financial never ever costs a payment for expenses your loan from early.

How about Additional Mortgage Costs and you will Closing costs?

Home financing is constructed of many charge. Commonly you will find your house assessment payment, titling fees, identity insurance coverage, and you will depending on where you live flooding degree charge to blow during the time of closure. These types of charge are accumulated by the financial on the part of third-parties that assist home purchasing processes.

Condition and regional taxes try part of the fees one you will additionally find in your final amount borrowed, and for those who get a hold of to pay your house insurance policies and taxation using your month-to-month loan repayments (escrow). To learn more and more the very last charge you really need to imagine when purchasing a property, check out the mortgage faqs web page. Settlement costs is a thing that your loan officer will show you inside complete for you.

At Guarantee Bank, we have been ready to always address questions that you may has actually throughout the to get a separate house and you can taking out home financing. Get in touch with one of our Home mortgage Officers in order to plan a consultation!