2023 Federal Protect Va Mortgage Guidance and Qualification

Va loan eligibility having members Place for ADS of the fresh National Shield

All of our Federal Guard gamble instance a crucial role within nation’s protection, and are entitled to becoming managed as the equivalent borrowers with most other Experts. All of us National Shield and Reserve troops basic gained accessibility the fresh new Experts Management (VA) financial work for into the 1992. Although not, rules has gone by within the 2020 a newer Virtual assistant financing eligibility laws known as Johnny Isakson and you may David P. Rowe, Yards.D. Veterans’ Healthcare and you may Advantages Upgrade Work out of 2020.

National Shield Va Mortgage Qualification

What is this suggest? It indicates productive-obligation solution people and you can National Shield players have access to a similar Va loan pros that have aided years away from veterans and active-duty services people achieve the Western desire owning a home. This allows members of brand new national shield to make use of its Va mortgage far, much prior to when they otherwise might have been capable previously.

Very, to buy property is a significant bargain, whether you’re a veteran or otherwise not, as well as for those who work in the fresh Federal Shield which, over the past number of years, have been called toward action having everything from natural disasters and insurrections throughout the DC town into Covid-19 trojan. These individuals were installing extended hours, besides getting weekend fighters.

The brand new no deposit Va loan program merely turned into so much more generally designed for American National Protect professionals, thanks to the the rules enacted inside the 2020. So if you understand a member of the fresh National Protect or a partner of a deceased National Guardsman which could take advantage of this particular article this would be a good blog post to fairly share.

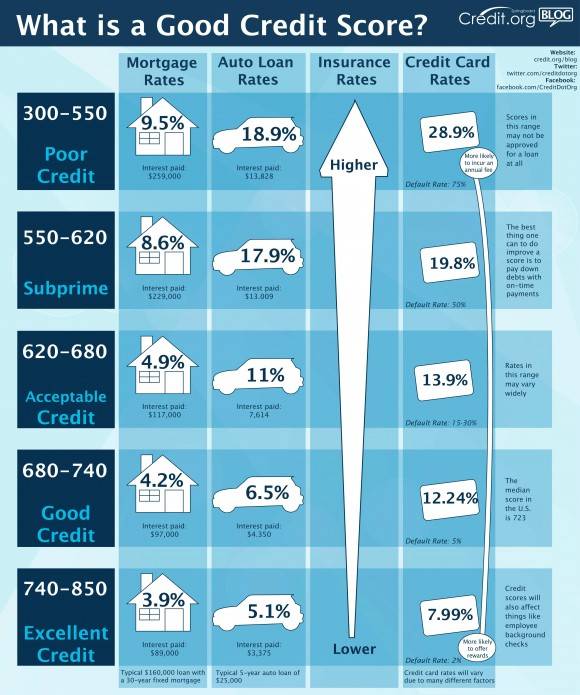

To acquire property the most expensive instructions most individuals will actually ever build. In addition cost together with advance payment, there are settlement costs, notice, or any other charges of this purchasing a house. However, people currently helping throughout the armed forces or who will be Experts is take advantage of an authorities-supported non currency off Va home loan.

Virtual assistant Mortgage National Protect Standards

Very, before the the latest regulations. Solely those whom offered from the guard might be thought having the brand new Va mortgage program once they had 90 straight weeks regarding productive provider otherwise, had accomplished six years of solution, any came very first. Now the fresh threshold is actually ninety days away from full-day solution, which have one or more period of 30 consecutive months.

Making this the alteration, hence alter try retroactively applied. So that the national guard company, the united states, estimates one to fifty,000 guardsmen has actually simply achieved fast access the new Va loan benefit. Just how great would be the fact!

Name 32 Virtual assistant Financial Eligibility

Today, or even know the rules, it gives supply shorter, as well as gets entry to National Shield professionals exactly who just have what exactly is named Label thirty-two obligation, thus Lawn Set-aside members usually are called to Productive Solution less than a few more Areas of Federal Law.

Identity 10 and you may name 32, title thirty two requirements are purchased by the governor of the federal authorities or take place for the solution member’s household condition. Identity ten is actually an order from the fresh new chairman and can be taken to own functions around the globe. The fresh term thirty-two obligations must have already been did lower than among another components in order to meet the requirements. On this page we will merely focus on the a few yet not you will find about 5 rules in most.

This type of the fresh new Va financing qualification laws almost protection your in the event that you’re a national Shield associate regardless if you are studies to possess school otherwise starting drills. It’s all shielded, but you will find little points that aren’t protected by Name thirty-two. Click here for additional information on army service details.

National Protect Va Loan Investment Fee

Va home loans are supplied because of the authorities from the Service of Veterans Affairs (VA). They’re offered to eligible pros as well as their parents. Virtual assistant fund don’t require individuals to put hardly any money off, so they’re also known as no money off loans.

They actually do, however. Still need to spend an initial funding percentage to aid offset the loan prices for You.S . taxpayers. Now the cost is as very much like step 3.6% of loan amount. We have found a quick chart types of featuring the individuals Virtual assistant funding charge that we had been these are.

Start a national Protect Virtual assistant financing

In order to qualify for a national guard Virtual assistant mortgage, you should first rating a certification regarding Qualification (COE) on the Virtual assistant. National Virtual assistant Finance can help you accomplish that provide us with a great in (855) 956-4040 to begin. This new Va financial system is truly among the best otherwise an educated financial product in the industry. Begin now having a no deposit Va home loan.